Prepared after all other budget estimates are completed. Production budget is prepared on the basis of the sales budget.

Types Of Budgets The Four Most Common Budgeting Methods

6 Important Types of Budgets Explained.

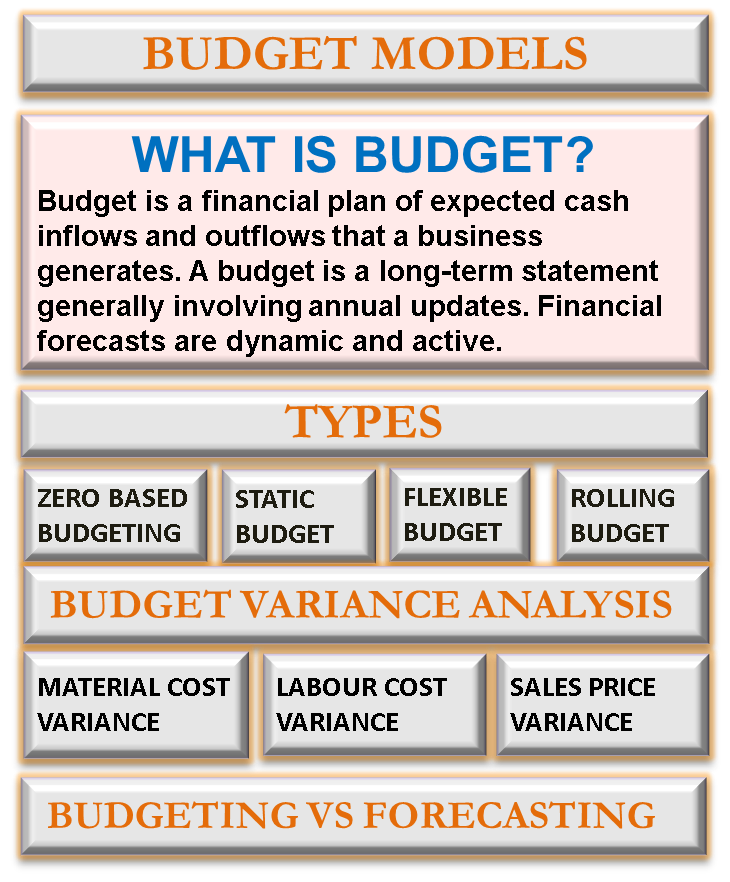

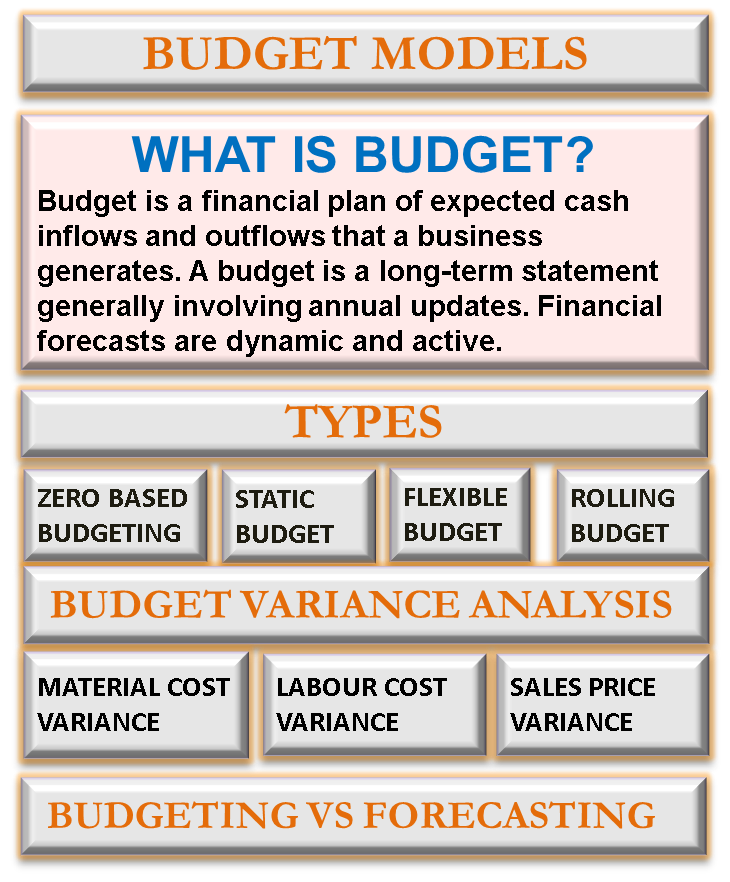

. Enacted Budget law. Classification of Budget according to Function Flexible Budget It is prepared for a range for more than one level of activity It is a set of alternative budgets to different levels of activity Flexible budget is prepared considering that a business is dynamic ever changing and never static Important features of flexible budget. This article throws light upon the ten main types of budget used in an organisation.

Following are the budgets that comes under the above categories. Budgeting is performed for planning and control purposes. Shows the anticipated receipts and expenditures the amount of working capital available the extent to which outside financing may be required and the periods and amounts of cash available.

On the Basis of Nature of Business Activity. Compare actual spending with approved budget doesnt show information on service delivery Supplementary Budgets. Fixed and Flexible Budget.

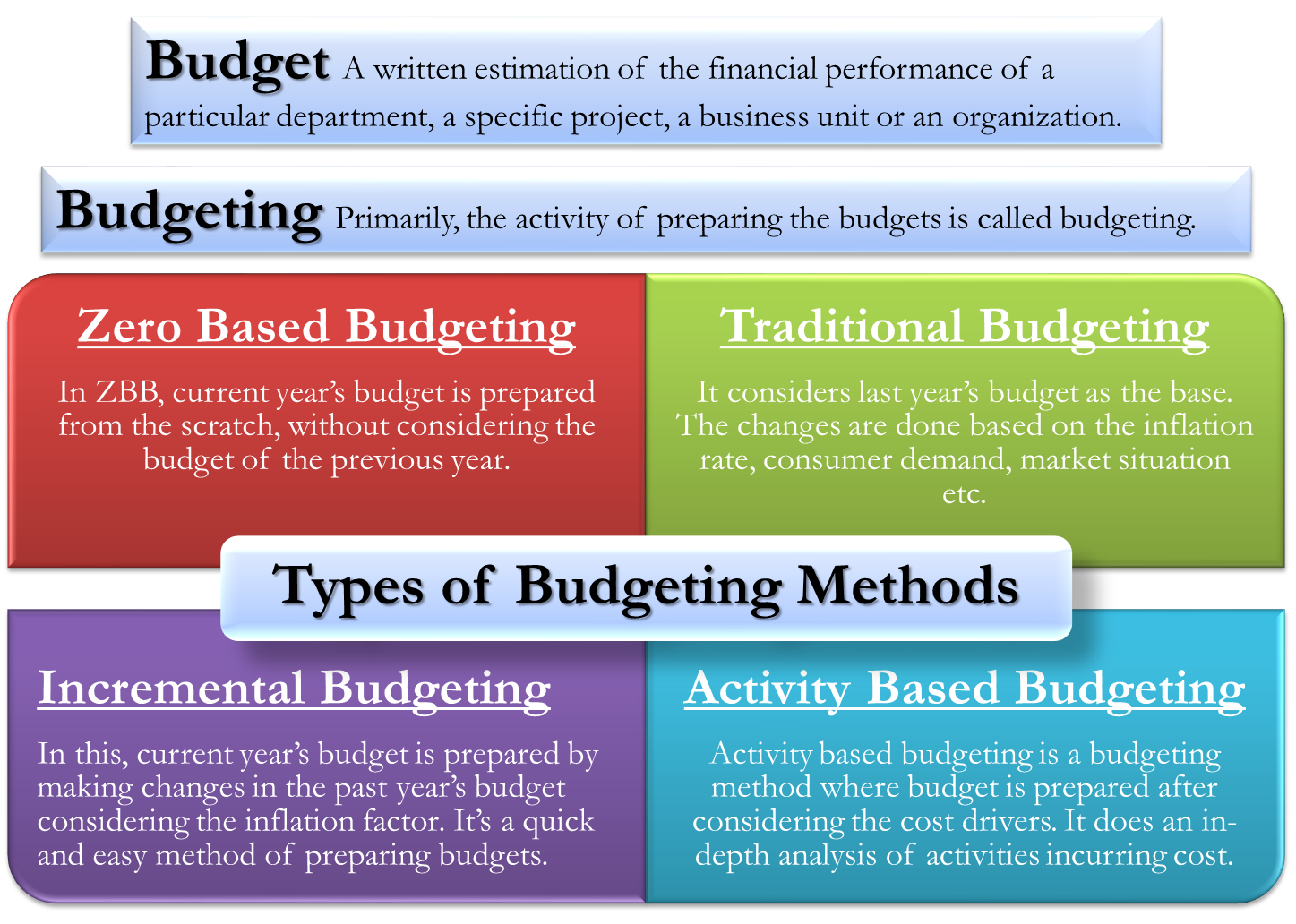

Listed below are the most popular types of business budgeting methods. Zero Base Budgeting 6. The cash flow budget determines.

There is a variety of budgets. A cash flow budget is more about managing the cash of the business. Types of Budgets Master Budget.

The process gets managers to consider how conditions may change and what steps they need to take while also allowing managers to understand how to. Budgeting allows identifying and setting business objectives and goals. Plant Utilisation Budget 2.

On the Basis of Function 3. Direct Material Budget 4. On the Basis of Time 2.

Performance Budget Fixed Budget Flexible Budgets Incremental Budget Rolling Budget and Cash Budget. Essential to every business. The most common budget types include the following.

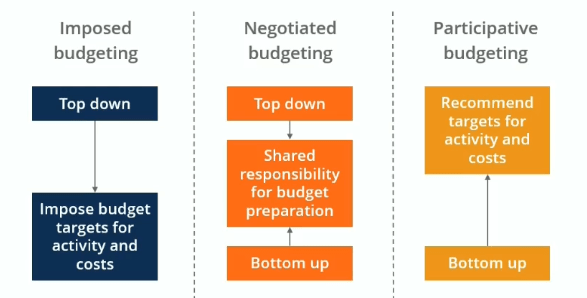

Participatory budgeting is a budgeting process that starts with departmental managers and flows through middle management and up to top management. Produced on monthly quarterly or mid-year basis. Traditional budgeting is a budget preparation method that considers last years budget as the base.

Mostly budget preparation follows one of these methods. According to time budgets may be classified as. Reflects what government is legally obliged to spend its funds on during budget year In-Year Reports.

The budget designed by the management for a long-term ie. A budget is the monetary orand quantitative expression of business plans and policies to be pursued in the future for future budgets and other procedures for planning co-ordination and control of business enterprise. And the general operating budget may cover a quarter or a year.

The following points highlight the four types of classification of budget. Cash budgets may cover a week or a month. Production Cost Budget 3.

Classification of Budgets. 10 Types of Budget that exist for Businesses 1 Cash flow budget. Budget can be divided into various types.

Budgeting is a critical process for any business in several ways. Budgeting involves the coordination of financial and nonfinancial planning to satisfy organizational goals and objectives. A forecast of projected income and expenses along with its analysis over the course of a specific.

Each new level of management has responsibility for reviewing and negotiating any changes in. So a budget is a pre-determined statement of management policy during a given period which provides a standard for comparison with the results actually. Predicting when and how the cash will flow in or out of the business is called a cash flow budget.

Three to ten years is called as long-term budget. As the name suggests the budget which is prepared for a period ranging from 1 to 2 years is called short-term budget. Sales Budget Production Budget Purchase Budget Labour Cost Budget Cash Budget Fixed Budget and a Few Others.

The five different types of business budgets are capital operating cash sales and personnel. What is the Traditional Budgeting Method. And each has its own place in business accounting.

Factory Overhead Budget 7. The following points highlight the nine types of budget. But it also takes into.

On the Basis of Flexibility 4. Administrative Overhead Budget 9. Performance budget lists all the activities carried out in the organization along with their outcomes.

Mentioned below are brief explanations of these three types of budgets. Sales and production budgets may cover a month a quarter or a year. No foolproof method exists for preparing an effective budget.

Depending on the feasibility of these estimates budgets are of three types -- balanced budget surplus budget and deficit budget. A government budget is said to be a balanced budget if the estimated government expenditure is equal to expected government receipts in a. Distribution Overhead Budget 8.

Types of Budget in Cost Accounting 8 Main Types. A sales budget is an estimate of expected total sales revenue and selling expenses of the firm. Aids in the planning of actual operations.

On the Basis of Time. Allows government to revise. Up to 256 cash back Zero-based budgeting requires managers to build budgets from the ground up each year.

A static budget is a type of. The master budget is the sum total of the companys budget that includes the allocation of funds to.

Budget Models Types Of Budgets Budget Variance Analysis

Budgeting What Is Budget Types Choose Best Techniques Method

0 Comments